Whether GST is not levied on Bad debts. Receivable becomes a bad debt the vendor may claim bad-debt relief if the bad debt is written off in the businesses books.

1 Goods And Services Tax Gst Introduction To Gst Ppt Download

Get a Free Consultation.

. You have to meet the following conditions to qualify for bad debt relief. As per the provisions of Section 9 of CGST Act GST is. GST Implications on Association of Apartment Owners.

National Debt Relief Receives the Top Ranking in Our Evaluation. The remaining 1360 is written off to bad debt. Get a Savings Estimate.

GST-15_Bad Debt What is 6 Months Bad Debt Relief. Qualifying for Bad Debt Relief. To work out how much GST is included in the debt multiply by the GST fraction 5105 you can claim a refund for bad debt of 515 x 5105 2452.

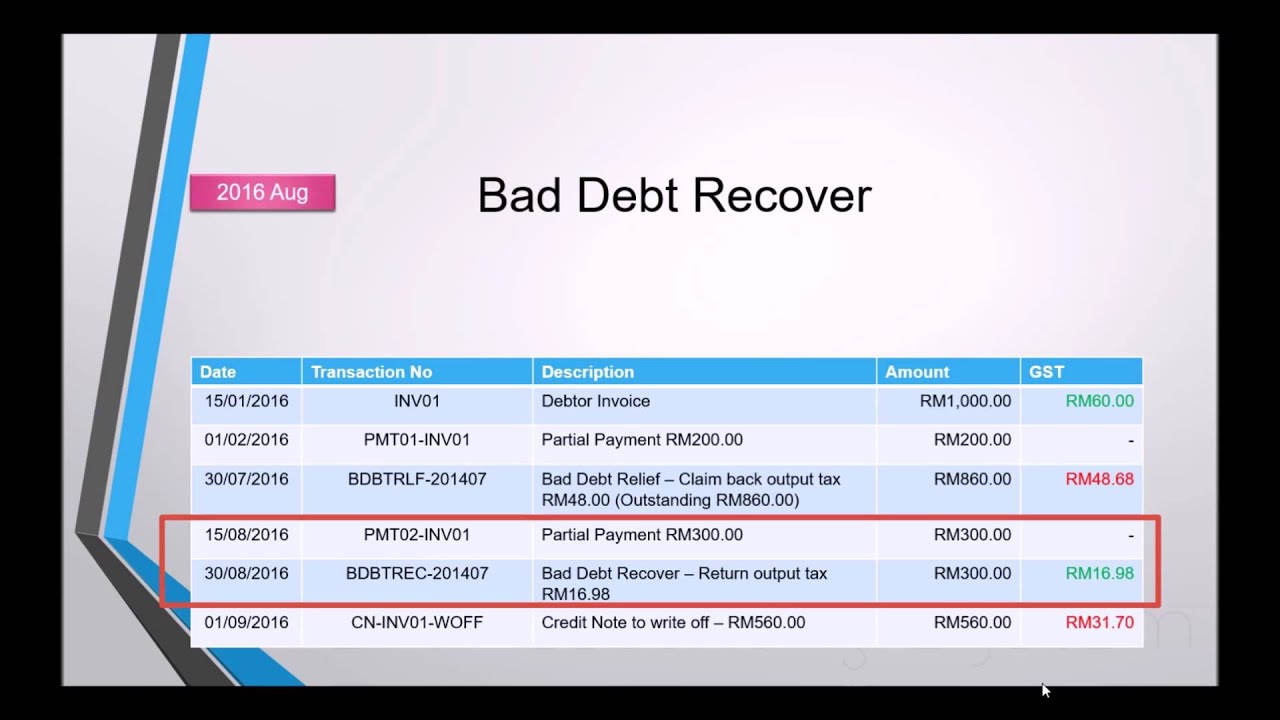

Obligation to make GST accounting entry for repayment of input tax under Article 36A 1 A person who. Dr Bad Debt 200000 Dr Input Tax 12000 Cr Debtor 212000 If the customer pay you after you have claimed the Bad Debt relief from the Kastam You to do the following accounting entry-. I have accounted the output tax on the supply on which bad debt relief was claimed iii Bad debts recovered and GST amount in Refund for Bad Debts account Section 4.

Compare Best Offers Now. Also if you see the exclusion list of section 15 the only one term ie. DISCOUNT shall be excluded from the value of taxable supply and there is no specific exclusion under.

Quebec Revenue Agency the Court of Quebec the Court per the Honourable Jo Ann Zaor ruled that the plaintiff. Has not paid the whole or any part of the consideration for a supply by the end of. Are you considering the solutions of a financial debt settlement company financial debt negotiation consolidation or a tax obligation financial debt alleviation company gst bad debt.

Ad Free Independent Reviews Ratings. A GST registered business can claim bad debt relief GST Tax amount paid earlier to Kastam if they have not received any payment or part of the payment from their. To issue Bad Debt Relief you just need navigate through.

Subsection 2311 provides that the vendor may claim a deduction. Ad 5 Star Rating by Top Consumer Reviews. On June 10 2020 in Greenfield Mining Services Inc.

Click on the New button. This feature supports bad debt relief for GST Return for Singapore. The CRA generally takes the view that a debt is considered a bad debt when all reasonable steps have been taken to obtain payment and it has become evident that the debt.

Then follow the following steps. Ad 5 Star Rating by Top Consumer Reviews. You have supplied goods or services for a consideration in money and have accounted.

If you hold a security against the debt. I have accounted the output tax on the supply on which bad debt relief was claimed iii Bad debts recovered and GST amount in Refund for Bad Debts account Section 4. National Debt Relief is Our Highest Rated Debt Relief Company on All the Parameters.

Company A can get back the part of the 260 HST. A GST registered business can claim bad debt relief GST Tax amount paid earlier to Kastam if they have not received any. When debts cannot be recovered you can apply for bad debt relief to recover GST that is charged but unpaid by.

If bad debts are on account of deficiency in supply of services or tax charged being greater than actual tax liability or goods returned GST paid on the same is refundable. Tax Customer Bad Debt AR Bad Debt AR. Unbiased Expert Reviews Ratings.

Get a Free Consultation. Learn how to handle Bad Debts Relief in QNE GST Compliant Software. Company A manages to collect 900 before Company B goes bankrupt.

Get a Free Consultation. If the debt is written off in the same income year as it became a bad debt that is before 30 June 2020 Landlord Pty Ltd can claim a deduction of 15000 for the bad debt written off. BBB A Accredited Companies.

Ad View Editors 1 Pick.

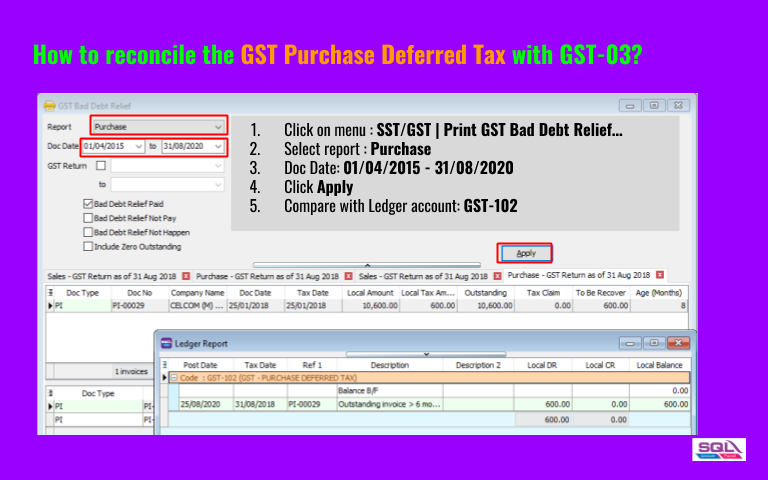

Gst Sales Purchase Deferred Tax Journal Adjustment Estream Software

Transitional From Gst To Sst Estream Software

Gst Sales Purchase Deferred Tax Journal Adjustment Estream Software

Outstanding Invoices Not Shown As Gst Bad Debt Relief

Gst Bad Debt Relief Madalynngwf

Realtimme Cloud Solutions Helpfile

Realtimme Cloud Solutions Helpfile

Gst Bad Debts Relief Compulsory Checking At Gst03 Help

This Time Really Final Date 31 08 2020 Amending Your Final Gst 03

Gst Bad Debts Relief Compulsory Checking At Gst03 Help

Yyc Advisors The Most Complicated Issue In Gst Is Coming Facebook

Gst Bad Debts Relief Compulsory Checking At Gst03 Help

Gst Bad Debt Relief Madalynngwf

Gst Bad Debt Relief Madalynngwf